What does 'AVS rejected' mean?

In today's digital world payment fraud is really a significant problem for businesses and merchants. In cases of shopping fraud, pinpointing the individual making the purchase can be challenging. This difficulty arises because credit and debit card information can be stolen or duplicated, allowing fraudsters to make online transactions.

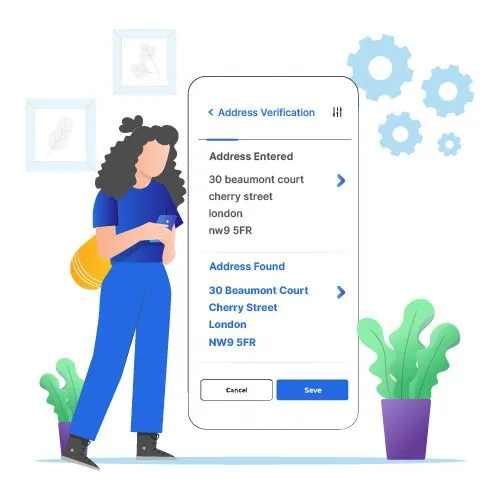

To counter this many merchants nowadays are using AVS (Address Verification Service). This article will comprehensively cover what AVS is?, its functionality and what happens if AVS is rejected (The address you provide at checkout doesn't match the address linked to your card).

What is AVS, and how does it work?

AVS, or Address Verification Service, is a tool used to confirm the address associated with a credit card or debit card transaction. This service is used to prevent fraud while paying online or by phone. This is how it works:

1) AVS checks the address you enter at checkout against the address that the card issuer (like Visa or MasterCard) has on file for your card.

2) When you make a payment, the merchant asks the card network or bank to compare these addresses. The card company or bank sends back a code showing how well the addresses match.

3) The objective is to verify that the individual making the payment is the actual cardholder.

This service is available in the U.S., Canada and the UK through Visa, MasterCard, Discover, and American Express. The merchant utilizes the AVS information to determine whether to approve or decline the transaction.

Advantages and Disadvantages of AVS for Business

If your business is accepting online payments, using AVS can prevent your business from big problems. This fraud and chargeback prevention tool will protect your business from the risk of fraud, losing money, chargebacks and losing your merchant account. However, AVS has its advantages and disadvantages.

Advantages of AVS

1) Fraud Prevention: AVS checks make sure that the person who orders and the cardholder are the same. AVS checks confirm that the address and zip code used for an order match the details on file with the customer's bank. This stops unauthorized people from using a credit card on your online store.

2) Chargeback Prevention: AVS helps prevent chargebacks. If the card details don't match, it's less likely that fraudsters can successfully dispute a transaction.

3) Fast Processing: This tool checks addresses with speed therefore, the payment process doesn't slow down if the information is correct.

4) Cost-Effective: This tool is not expensive. Therefore you can implement cost-effective tools and systems for fraud prevention.

Disadvantages of AVS

1) Not able to prevent all fraud: AVS can't catch every instance of fraud. If a scammer has the correct address, AVS might not prevent the transaction.

2) Risk of blocking legitimate transactions: If a customer enters their address incorrectly or hasn't updated it with their card issuer, AVS might mistakenly decline a valid transaction.

3) Complaints: Some customers might get frustrated if their legitimate transactions are blocked by AVS, which could lead to negative reviews or complaints.

What is the meaning of "AVS Rejected"?

When a cardholder's address matches the address the bank has on file, AVS confirms it, and the payment goes through. But if the addresses don't match, the system will show an AVS mismatch error, and the payment will be declined.

This process helps stop fraud by checking that the card information isn't stolen.

Thus, as a merchant, you can either reject payments if it has AVS errors and suspend fraud, or you can accept those payments if your customer is trustworthy.

AVS mismatch error and its mechanism

When a customer gives their address at checkout, AVS checks it against the address the card issuer has on file. For the payment to go through, both the zip code and house number need to match.

Here are the three possible results:

1) AVS Match: The address the customer provided matches exactly with the card issuer's address.

2) AVS Partial Match: Either the zip code or house number matches, but not both.

3) AVS Mismatch: Neither the zip code nor the house number matches the card issuer's address.

How can Merchants prevent an AVS Rejection?

If you get an AVS rejection, how you handle it depends on how much risk you're willing to take. Here are three options:

1) Reprocess the Transaction: If it's a wrong address entry by the customer and you think that address mismatch is a mistake. You can try to reprocess the transaction. If the customer corrects their address, there should be no AVS rejection, and the payment should be processed successfully.

2) Override the AVS Check: If you have confirmed with the customer that they are the cardholder and if there's an AVS mismatch, you can still choose to approve the payment. But this could make your business more vulnerable to fraud.

3) Cancel the Order: You can cancel the transaction if the customer is unable to provide the correct address or update it with their card issuer. This may reduce the risk of fraud but may also disappoint the customer and they can leave negative reviews.

Chargeback and AVS

Most payment processing systems allow merchants to decide how much an AVS check affects the final decision on a payment. Merchants can choose which mismatch codes are more important or even turn off AVS entirely. However, if merchants turn off the AVS, it could make it harder to handle chargebacks and could indicate that the merchants are not taking measures to prevent fraud.

With only basic fraud prevention, merchants might face more chargebacks. and find it tougher to dispute them. However, if they turn on AVS and use it for every transaction, it exhibits their seriousness about preventing fraud. It will also assist merchants in combating chargebacks more effectively.

Fraud and AVS

Some types of fraud bypass AVS. They are listed below:

1) Friendly Fraud: In this type of fraud the customer falsely claims that their card was stolen or they didn't get their package, even though they did. The customer initiates a chargeback for a legitimate transaction. Since they know their address, they can easily get past AVS.

2) Advanced Fraud: Skilled scammers can bypass AVS if they have both the card and the correct address. If a thief has the right address information, AVS won't be able to detect the fraud.

Key Takeaway

Fraud is an important problem for businesses nowadays. Debit and credit card information can be stolen and misused by fraudsters online. Thus, many merchants are now using AVS to counter this problem. AVS stands for Address Verification Service. This service is used to prevent fraud while paying online or by phone. AVS checks the address you enter at checkout against the address that the card issuer has on file for your card. This service is available in the U.S., Canada and the UK through Visa, MasterCard, Discover, and American Express.

The pros of AVS include fraud prevention, chargeback prevention, fast processing and cost-effectiveness. The disadvantages are that it is not able to prevent all fraud, and it carries the risk of blocking legitimate transactions.

So what does AVS rejected mean? When a cardholder's address matches the address the bank has on file, AVS confirms it, and the payment goes through. If the addresses do not match, the system will display an AVS mismatch error, and the transaction will be declined. However, merchants can prevent an AVS rejection by reprocessing the transaction, overriding the AVS check and canceling the order. In conclusion, AVS is a really useful tool to prevent fraud, turning it off will increase chargebacks and risk of fraud.

William Harrison

William is a consultant providing expertise in business management. He has successfully integrated POS systems into various businesses, demonstrating a passion for improving processes and offering financial advice. With a decade of experience in dealing with POS systems, payment gateways, and ATMs, he is also a passionate writer about finance and accounting.