What Is Billing Information? Meaning And Significance.

In today's modern world, billing information plays an important role in ensuring smooth and secure transactions between customers and businesses. But before diving deep into this subject, first of all, we should know what billing information is and why it is important for merchants.

In this article, we will find out what billing information is, why it is important for merchants and how you, as a merchant, can manage it to secure your business transactions.

What Exactly Is Billing Information?

Billing information is the details that a customer provides to a merchant for the completion of a financial transaction. It is used for invoicing, payment processing and fraud prevention. The elements of billing information include:

Name of Cardholder: The full name of the person or entity that owns the card.

Billing Address: The address linked to the customer's payment method, like their credit card or bank account.

Contact Details: The phone number or email address of the client associated with the mode of payment.

Credit or Debit Card Details: Information about the customer's payment method, including card number, expiration date, and card security code (CVV).

Shipping Information: Not always necessary but some merchants may collect shipping details for products that need to be delivered.

These details are necessary for completing transactions, verifying payments and providing customer support in case of disputes. Therefore, they are critical to merchants.

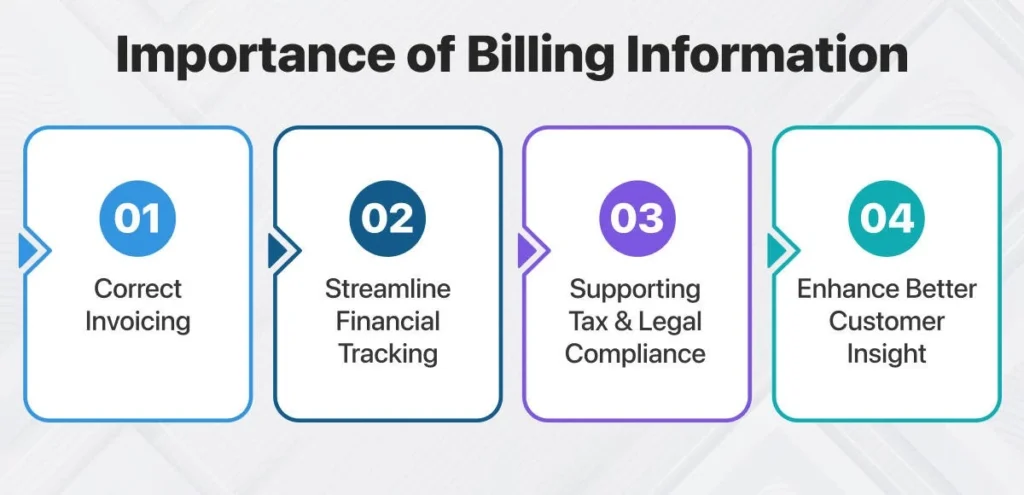

Importance Of Billing Information For Merchants:

Billing information is necessary for merchants due to the following reasons:

1) Accuracy of Transactions

Providing correct billing information guarantees proper processing of payments. If the billing address doesn't match the one on file with the customer's bank or card issuer, the transaction may be declined or flagged for fraud. For merchants, ensuring that billing information is correct helps to reduce errors, avoid failed transactions, and maintain cash flow.

2) Prevention of Fraud

Many retailers put a lot of effort into protecting themselves and their clients from fraud. Payment processors verify that the person making the payment is the legitimate owner of the payment method by using billing information, particularly the billing address and card verification code (CVV). Many merchants use tools such as Address Verification System (AVS) and 3D Secure to reduce fraudulent charges and chargebacks. Therefore saving their business's reputation and stability.

3) Compliance and Audit

While handling this information, merchants must comply with several regulations and standards, such as the Payment Card Industry Data Security Standard (PCI DSS), which requires businesses to take precautionary steps when storing, processing, or transmitting credit card information. Penalties, security problems, and a decline in customer trust could result from breaking these rules.

4) Customer Relationship And Communication

Billing information usually helps when communicating with customers. For example, merchants can send invoices and receipts to customers' email addresses once a payment is processed. If there are any issues with the transaction, such as chargeback and disputed payment, the correct billing details help facilitate the timely resolution of disputes, thus maintaining strong customer relationships.

How to Collect Customer's Billing Information?

Following are the ways to collect customer's billing information safely:

1) Secure Payment Gateways:

Payment gateways secure sensitive information, like credit card numbers and personal details, by encrypting it before transmitting it online. When selecting a payment processor or gateway, ensure it follows industry-standard security protocols, such as SSL encryption, to protect customer information.

2) Tokenization:

Tokenization is a technique that substitutes sensitive billing details with unique identifiers, known as 'tokens,' which can be used instead of the original data. This reduces the risk of data breaches, as even if tokens are stolen, they are useless without the decryption key. Tokenization is especially important if you store billing information for recurring payments.

3) Data Retention:

You should limit how long you store this information. Merchants should retain customer's information until a transaction is completed. If you keep this information beyond this period, you can face unnecessary business risks. You should properly delete the customer's information once it's no longer needed.

4) PCI DSS Compliance:

PCI DSS provides a framework to safeguard sensitive customer information. Merchants must comply with PCI DSS standards by encrypting cardholder data, securing networks, and implementing access controls. If merchants fail to comply, they may face hefty fines and lose the ability to accept card payments.

Best Practices For Managing Billing Information

Here are some best practices for merchants to manage billing information effectively:

1) Multiple Payment Options:

Providing customers with various payment methods (credit cards, debit cards, PayPal, etc.) increases the likelihood of successful transactions. Each payment method may require slightly different billing information, so it's important to ensure your system is equipped to handle a range of data formats.

2) Effective communication with customers:

As a merchant, it's important to explain how their data is being used and safeguarded. Maintaining transparency while managing customer's billing information throughout the payment process will build trust, and you will have a strong relationship with customers and a likelihood of repeat business.

3) Warning Signs:

Be alert to typical signs of fraud, like inconsistent billing and shipping addresses, repeated payment failures, or unusual buying patterns. Taking action early can prevent significant losses.

Conclusion:

For successful and secure transactions, merchants usually rely on billing information, which is a crucial component of the payment process. Merchants should understand and manage this information effectively by ensuring payment accuracy, preventing fraud and maintaining legal compliance.

Merchants may optimize their payment systems, lower operational risks, and give their consumers a better experience by adhering to best practices, implementing secure payment technology, and upholding customer trust. After all, both your company and your clients gain when your billing procedure functions properly.

Increase your business potential with a FREE review and quote for your merchant account !

Don’t wait; claim your retail payment processing solution today and fuel your growth.

William Harrison

William is a consultant providing expertise in business management. He has successfully integrated POS systems into various businesses, demonstrating a passion for improving processes and offering financial advice. With a decade of experience in dealing with POS systems, payment gateways, and ATMs, he is also a passionate writer about finance and accounting.